CEF Bank (Caixa Econômica Federal) announced, in February this year, “Poupança Caixa” program, a new type of real estate credit in which the interest rate varies according to the Savings’ income and according to the client’s profile. Effective rates start at 3.35% per year, added to the additional savings remuneration rate: 70% of the Selic rate (basic rate of the Brazilian economy), when it is equal to or less than 8.5% per year, or 6.17% per year, when the Selic exceeds 8.5% per year. The debit balance of the financing is updated monthly by the TR (Taxa Referencial = Referential Rate).

The new line will be available for hire from March 1, 2021.

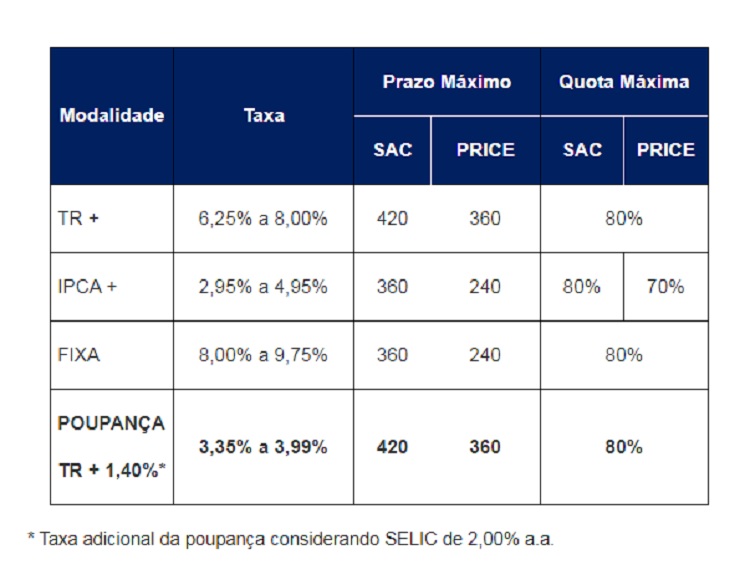

Caixa Bank now offers four real estate financing options with resources from the SBPE (Sistema Brasileiro de Poupança e Empréstimo = Brazilian Savings and Loan System), for the purchase of new or used property, construction and renovation. Check out:

Caixa bank remains the largest financier of home ownership in Brazil, with 68.8% of the market. In December last year, Caixa reached the highest volume of real estate credit in history. R$ 116.0 billion were contracted in 2020, growth of 42.4% in the last two years, with 564.6 thousand new financing.

Check out the full story at